You must submit your tax forms to Bottom Line in order to complete your application and join our program.

These forms are needed in order to ensure that you meet our income eligibility requirements as well as to complete important financial aid applications such as FAFSA.

Note: If your parent/legal guardian does not file taxes and receives benefits such as Social Security, Disability, or Unemployment, please send us a copy of that statement instead of a tax return.

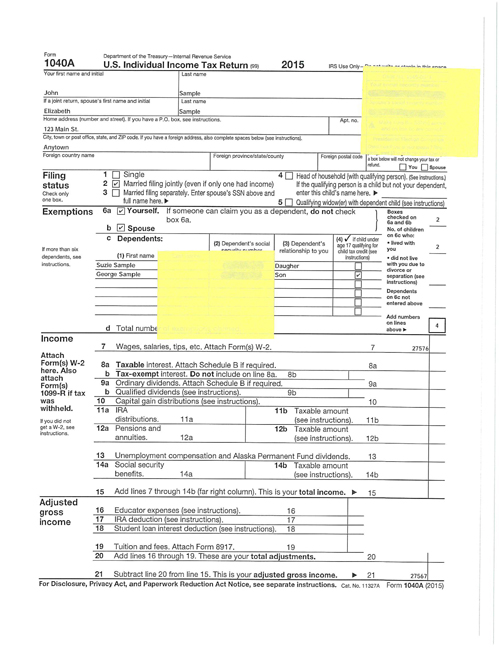

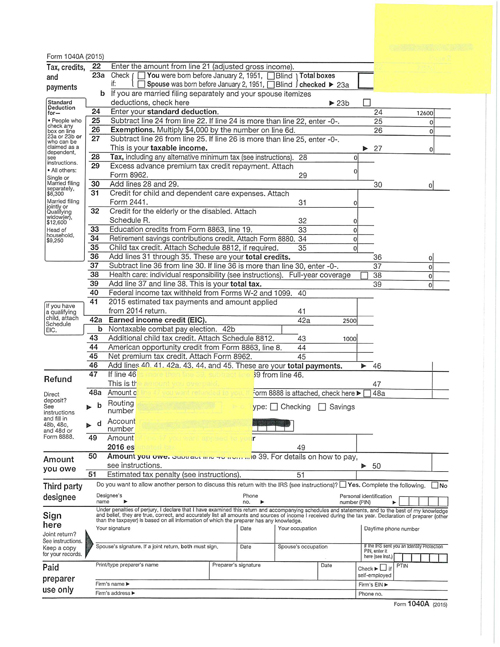

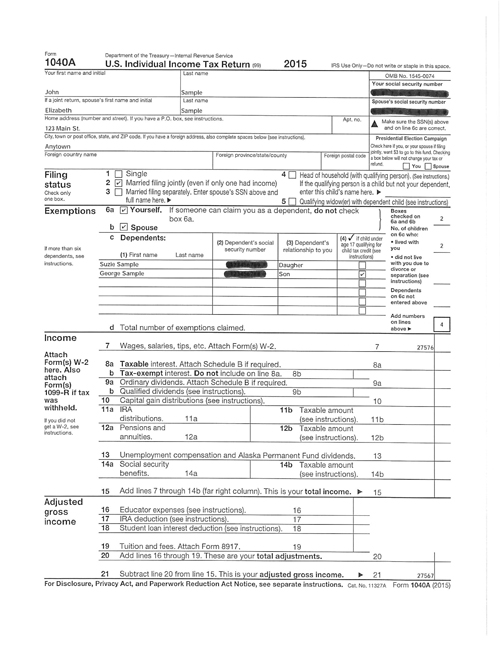

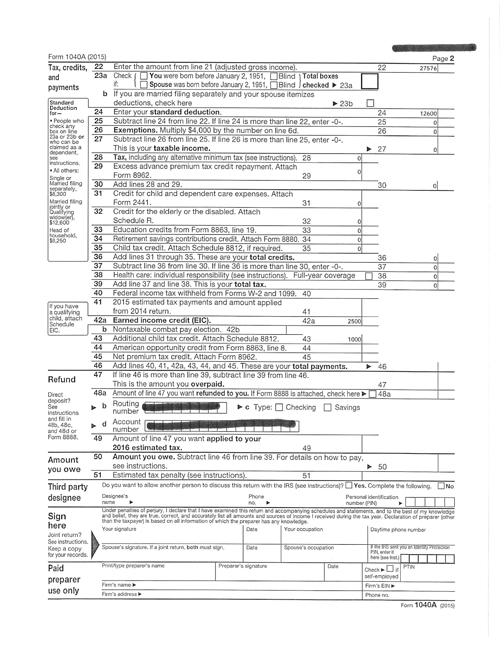

Step 1. Find Pages 1 & 2 of your parent/legal guardian’s 1040 Tax Return.

Step 2. Cover up all Social Security Numbers, Bank Account Numbers, and Bank Routing Numbers.

You can do this by covering up sensitive information with a sticky note or cross them out

with a marker.

See examples below:

Step 3. Send Pages 1 & 2 to Bottom Line via fax, texting a picture, or mailing to our office.

Step 4. Please do not include W-2’s or other pages of your tax returns.